Bayesian Statistics

Bayesian statistics offers a powerful framework for incorporating prior knowledge into data interpretation. Bayesian methods have gained traction for their flexibility in handling complex data structures and making probabilistic predictions. It is an active are in both statistical theory and applied statistics. Applications include:

- Machine Learning and Artificial Intelligence: Bayesian methods are extensively used in machine learning, particularly in the development of probabilistic models that make predictions or decisions based on uncertain data. These methods are crucial in areas like natural language processing, computer vision, and recommendation systems.

- Finance and Economics: Bayesian statistics are applied in finance for risk management, portfolio optimization, and econometric modeling. Financial analysts use Bayesian methods to incorporate market sentiment and historical data into their models, allowing for more flexible and realistic assessments of financial risks and returns.

- Biodiversity: The application of Bayesian statistics in biodiversity research offers a powerful framework for understanding complex ecological systems under uncertainty. This approach is particularly well-suited to address the challenges posed by the variability, complexity, and often limited data available in biodiversity studies.

Researchers in the Centre cover many different areas and applications: including spatial statistics, MCMC, time series analysis, network analysis and applications to complex and high dimensional data.

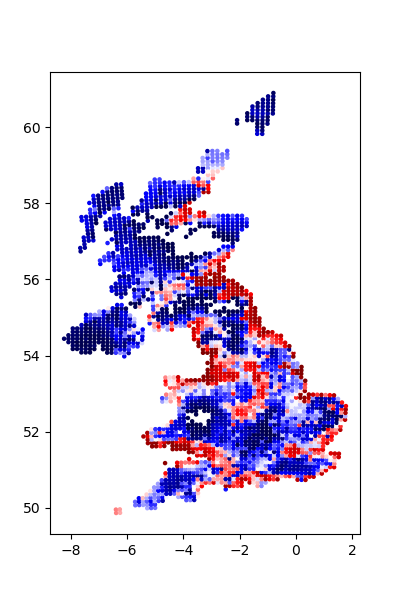

Distribution of a plant species in the UK

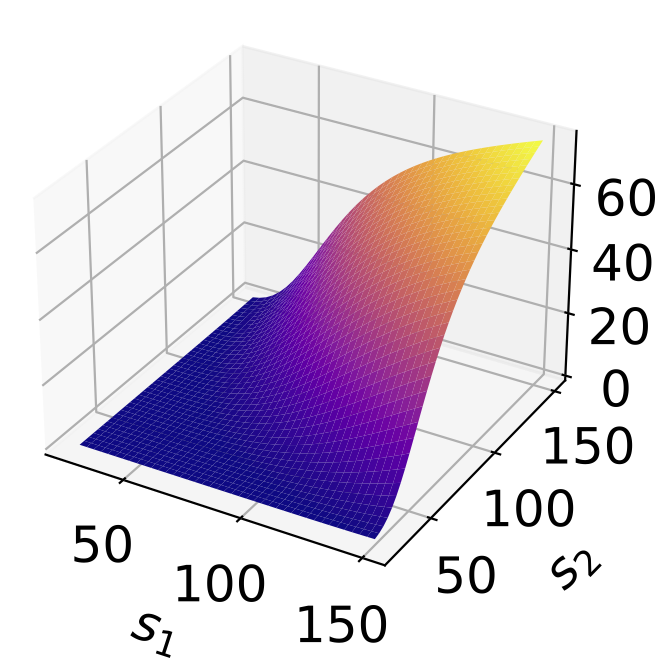

Understanding response profiles for neural networks